UNOBank Simplifies the User Experience for Adding and Sending Money with Brankas APIs.

Success Story

Enabled a simplified experience for both adding and sending money.

Removes the need for middlemen to facilitate fund transfers.

Better rates for sending money to other banks and e-wallets compared to others.

About UNOBank

UNO Digital Bank is Southeast Asia’s first full-spectrum digital bank licensed under the Bangko Sentral ng Pilipinas. Pioneering a new approach to banking: one that elevates you by making banking simple, better, and more accessible. UNOBank is your companion for solutions to financial needs in transactions, saving, borrowing, investment, and protection through products that are suitable for you, exactly when you need them.

Goal

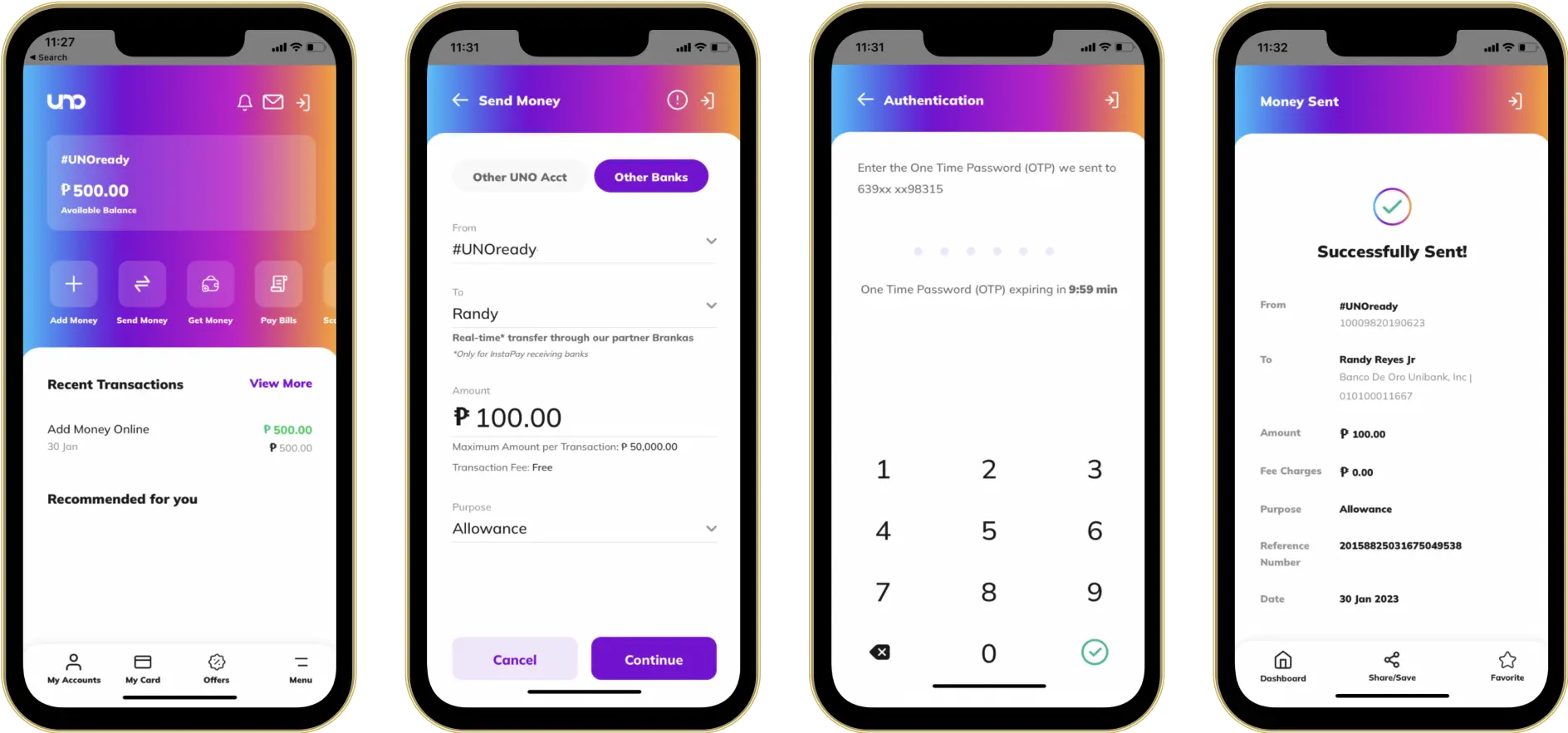

As UNOBank continually focuses on building a customer-first bank, the experience is a key factor in being successful. They wanted to ensure that users would have an easy and streamlined experience for both sending and adding money via their UNOBank account. By improving the experience of sending and adding money, this would add immense value to its users, even in a small way.

Problem they wanted to solve

There were two key areas that UNOBank wanted to focus on: (1) adding money to an UNOBank account and (2) sending money from an UNOBank account. As most payment gateways are seen as intermediaries or middlemen, the money is usually sent to a payment gateway, held for a certain period of time, and then settled with the merchant, in this case UNOBank, which is not an ideal solution for the digital bank. At the same time, sending money to other banks was something that was necessary, and UNOBank was not connected to the local electronic fund transfer services, so they needed a partner that could facilitate disbursements.

Solution that was implemented

After working with the Brankas team, UNOBank integrated both the direct and disburse Brankas APIs into their mobile application. The integration allows users to add money faster, without any middlemen, and send money to other banks and e-wallets without the extra layers and fees. Users can easily add money from UnionBank, BPI, and other banks and send money to BDO, GCash, Metrobank, Landbank, and over one hundred other banks and e-wallets. Ultimately, making the experience for UNOBank users simpler and one that aligns with the bank's goal of keeping everything customer-focused and giving users a great experience.

Scale your financial business with Brankas Payment APIs.

Join UNOBank and other businesses and provide a faster, better experience to your end-users.